START

1,55%

za wbudowane płatności IdoPay (PayByLink, BLIK, płatności odroczone PayPo, karty płatnicze)

0%

przy korzystaniu z Checkout 2.0

W IdoPay rozróżniamy 2 rodzaje cenników:

START

1,55%

za wbudowane płatności IdoPay (PayByLink, BLIK, płatności odroczone PayPo, karty płatnicze)

0%

przy korzystaniu z Checkout 2.0

BUSINESS

1,49%

za wbudowane płatności IdoPay (PayByLink, BLIK, płatności odroczone PayPo, karty płatnicze)

0%

przy korzystaniu z Checkout 2.0

EXPERT

1,49%

za wbudowane płatności IdoPay (PayByLink, BLIK, płatności odroczone PayPo, karty płatnicze)

0%

przy korzystaniu z Checkout 2.0

+

Możliwość stosowania innych zintegrowanych systemów płatności

ENTERPRISE

1,19%

za wbudowane płatności IdoPay (PayByLink, BLIK, płatności odroczone PayPo, karty płatnicze)

0%

przy korzystaniu z Checkout 2.0

+

Możliwość stosowania innych zintegrowanych systemów płatności

INDIVIDUAL

indywidualnie

za wbudowane płatności IdoPay (PayByLink, BLIK, płatności odroczone PayPo, karty płatnicze)

0%

przy korzystaniu z Checkout 2.0

+

Możliwość stosowania innych zintegrowanych systemów płatności

Przy dużych obrotach oferujemy indywidualnie negocjowaną stawkę procentową.

Umów darmową konsultację z naszym specjalistą i aktywuj bezpieczny system płatności IdoPay.

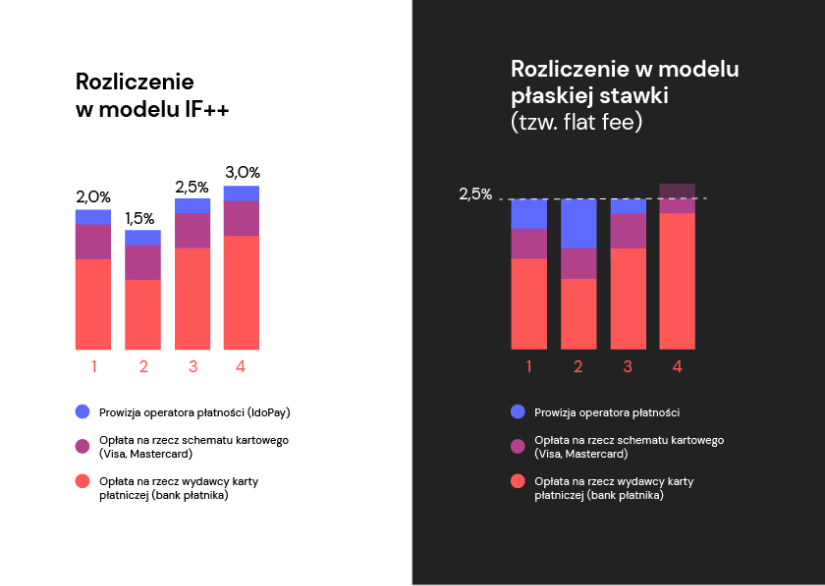

Żeby nie wpaść w pułapkę zbyt niskiej stawki płaskiej, stosujemy 2 oddzielne cenniki dla:

W przypadku kart płatniczych stosujemy do rozliczeń wyłącznie model IF++To system rozliczeń promowany przez organizacje kartowe Visa i Mastercard oraz Unię Europejską. W skład każdej płatności kartowej wchodzą 3 opłaty:

W ramach rozliczenia transakcji kartowej, operator płatności otrzymuje z systemu kartowego rozliczenie opłat interchange i opłaty systemowej, natomiast sam ustala jedynie wielkość swojej opłaty.

Opłaty interchange oraz opłata systemowa są regulowane przez cenniki systemów kartowych, przy czym część z nich, jak np. opłaty interchange za płatność kartami konsumenckimi w Europie są ograniczone np. Rozporządzeniem Parlamentu Europejskiego, dzięki któremu nie przekraczają 0,30% za transakcję.

Przydatne linki:

Środki z transakcji w twoim sklepie trafiają na rachunek IdoPay i gromadzone są na Twoim indywidualnym koncie. Wypłaty środków mogą być dokonywane niezwłocznie po ich zaksięgowaniu, a także co najmniej raz w miesiącu są automatycznie przelewane na twój zweryfikowany rachunek. Opcję automatycznych przelewów możesz ustawić by była realizowana częściej: raz na dwa tygodnie lub nawet raz na tydzień.

Z Twojego indywidualnego konta (tzw. Salda Wpłat (dawniej "Salda BOK")), pieniądze mogą być wypłacone na Twoje konto bankowe w PL:

Przelew w każdej walucie, następuje bez przewalutowania, w kwocie dokładnie takiej jak zgromadzone środki.

Więcej informacji o zasadach i szczególnych opłatach znajdziesz w Cenniku IdoSell.