Ułatwiamy prowadzenie sprzedaży zwolnionej z podatku od towarów i usług, jeśli Twoja firma nie jest płatnikiem VAT, dostosowując m.in. sposób generowania dokumentów sprzedaży i rodzaj rozliczania zamówień

Jeśli Twoja firma nie jest płatnikiem VAT, ponieważ korzystasz ze zwolnienia np. ze względu na wysokość osiąganych obrotów, to możesz teraz włączyć składanie zamówień i generowanie do nich dokumentów sprzedaży jako "brutto" (ale bez naliczania podatku VAT). To rozwiązanie ułatwia nie tylko prowadzenie sprzedaży zwolnionej z VAT na terenie Polski, ale również podmiotom działającym poza jej granicami np. w Wielkiej Brytanii.

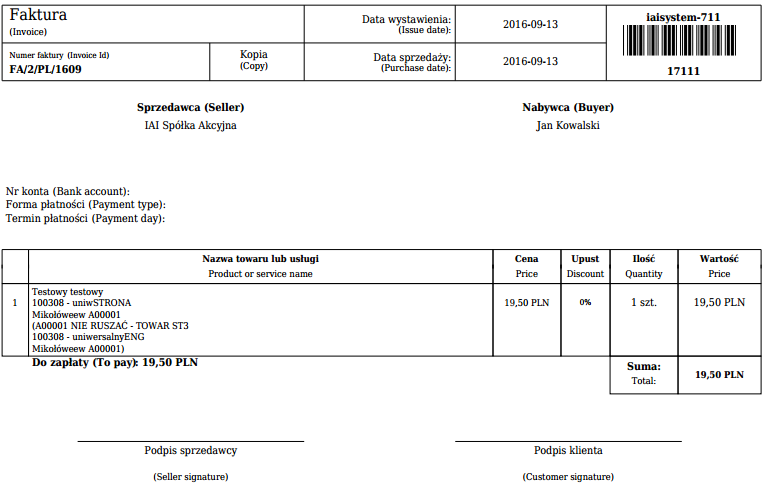

Po przełączeniu opcji "Płatnik VAT" w tryb "nie" (znajdziesz ją w sekcji ADMINISTRACJA / Dane Twojej firm), zamówienia zawsze będą składane przez Twoich klientów w rozliczeniu "brutto" i bez naliczania podatku VAT, a dokumenty sprzedaży będą generowane z pominięciem niepotrzebnych kolumn (np. "wartość netto") i z lekko zmienioną nazwą, która nie sugeruje że mamy do czynienia z dokumentem VAT:

W sytuacji, w której Twoja firma zacznie być płatnikiem VAT, to powyższą opcję możesz ponownie przełączyć w tryb "tak". Wówczas zamówienia będą składane domyślnie z rozliczeniem ustawionym w profilu dostaw, czy ustawieniem "Sprzedaż z VAT" na karcie klienta, a dokumenty sprzedaży będą generowane zgodnie z wyświetlaniem kolumn na dokumentach sprzedaży.

Sprzedaż bez VAT a template sklepu

Aby w template sklepu nie były wyświetlane informacje o stawce VAT np. przy towarach, w koszyku, koniecznie jest przystosowanie szablonu wyglądu sklepu do obsługi opcji "Płatnik VAT" ustawionej w trybie "nie":

- jeśli pkorzystasz z template STANDARD zmiany pojawią się przy jednej z najbliższych darmowych aktualizacji masek STANDARD i będzie potrzebna wtedy aktualizacja tego template

- jeśli posiadasz indywidualny template sklepu, konieczna jest jego aktualizacja, o ile już nie wykonałeś potrzebnych zmian.