Configuration of VAT rates for international sales. Automatic or manual mapping of VAT rates.

Setting other VAT rates is used if the company accounts for VAT in other countries using their local rates, has exceeded the threshold for sales to the European Union according to the VAT OSS procedure (One Stop Shop) or has voluntarily joined the VAT OSS.

In this case, the VAT rate (for products as well as for delivery costs) is determined on the basis of the applicable VAT rate in the buyer's delivery country.

In connection with changes in calculating VAT rates for sales to EU countries for B2C transactions, effective from 1 July 2021 under the so-called VAT e-commerce package, a new mechanism for automatic calculation of VAT rates has been introduced.

As a reminder, as of July 1, 2021, new lower thresholds came into force, beyond which you have to settle according to the VAT rates of the country of supply of the goods. The thresholds are set at 10 thousand EUR or 42 thousand PLN net. 10,000 EUR limit is calculated for all countries of the European Union

Therefore, currently in the IdoSell system you can use the automatic mechanism for mapping EU VAT rates as well as the existing manual configuration.

Setup and operation of the automated EU VAT mechanism

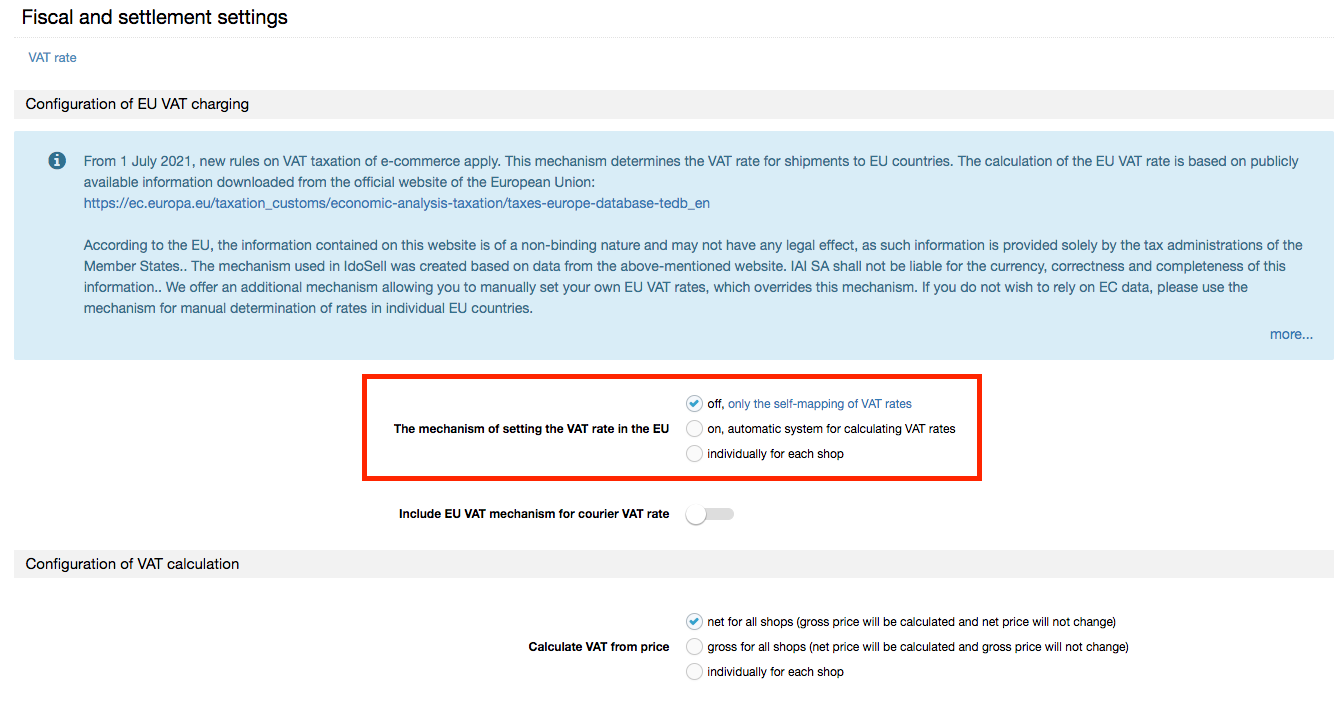

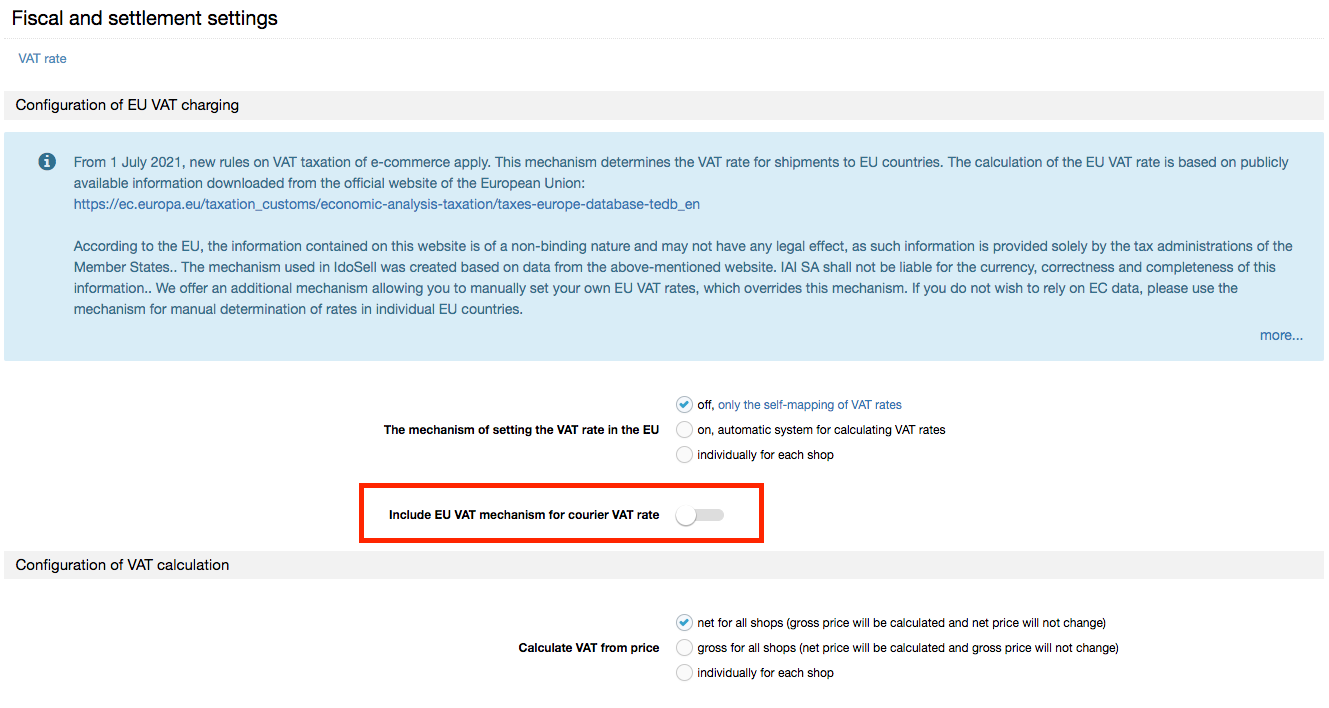

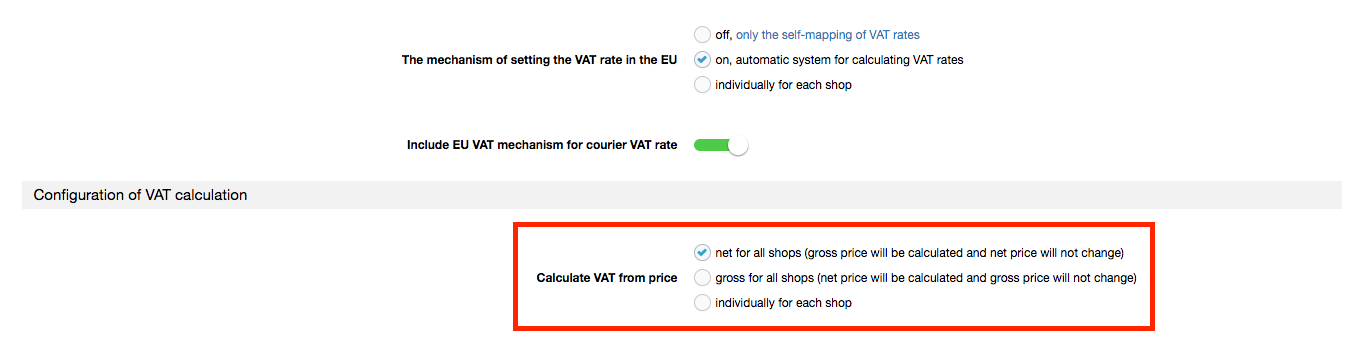

The new mechanism of calculating VAT rates based on the publicly available rate matrix provided by the EU can be activated in section ADMINISTRATION / Configuration of tax and billing settings. The module can be activated globally for the entire panel or individually per store.

Then the action depends on whether CN codes have been entered on the goods cards in the panel or not.

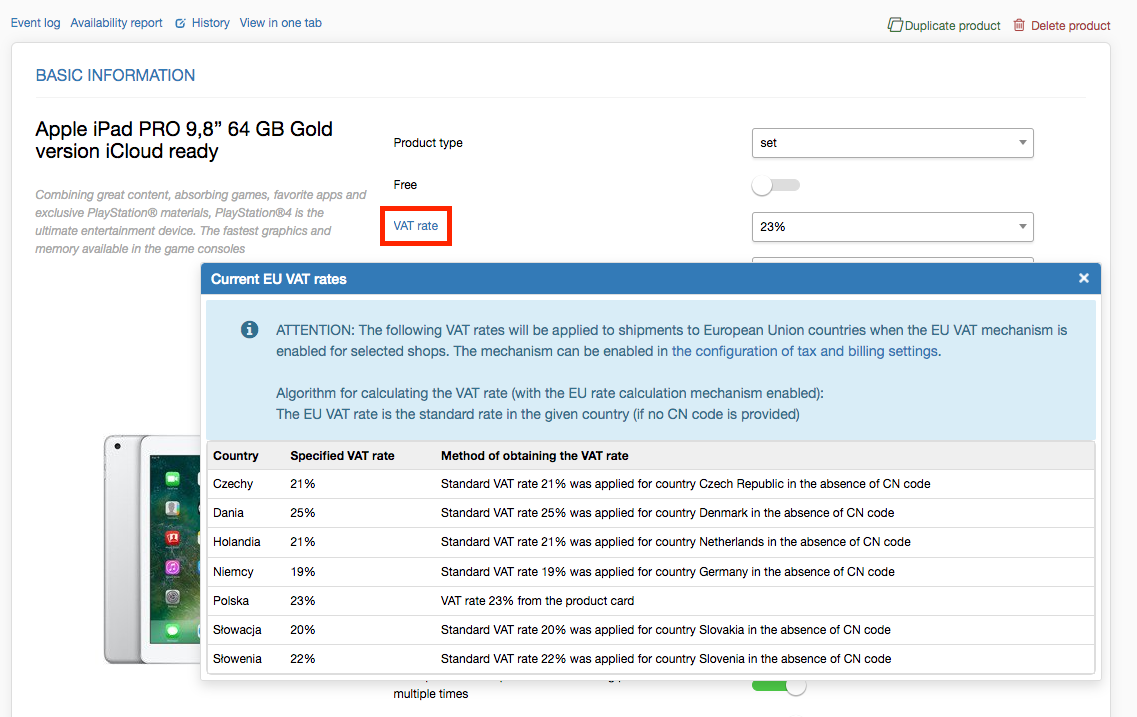

If CN codes are entered - the system searches the VAT rate matrix provided by the EU, taking into account the CN code and the buyer's delivery address. When a product with the specified CN code has a reduced VAT rate in the country and it is indicated in the EU matrix, the system will set it in the order. In case it does not find the full 8-digit code in the matrix, the system checks the higher sections until it finds the main CN code and its rate.

If CN codes have not been entered - the system, based on the delivery address of the customer, shall automatically set the basic standard VAT rate applicable in the given country, e.g. for Germany 19%, Czech Republic 21%, etc.

Completion of CN codes (optional)

The CN code is the Combined Nomenclature, which is a systematic classification of goods used for customs purposes, organizing all goods in circulation. CN codes are used within the European Union. They consist of 8 digits and are a development of HS (Harmonized System) codes used in most countries around the world.

CN codes can be determined on the basis of the EU TARIC nomenclature. The most convenient way is to use the Polish version of the Integrated Tariff Information System (ISZTAR). A text search engine is available (link: https://ext-isztar4.mf.gov.pl/taryfa_celna/Search?lang=EN) as well as the full nomenclature tree (link: https://ext-isztar4.mf.gov.pl/taryfa_celna/browseNomen.xhtml?suffix=80&country=&lang=EN ), based on which we can find the product.

It is also a good idea to contact your supplier or the manufacturer directly, who should have information on CN codes for their goods.

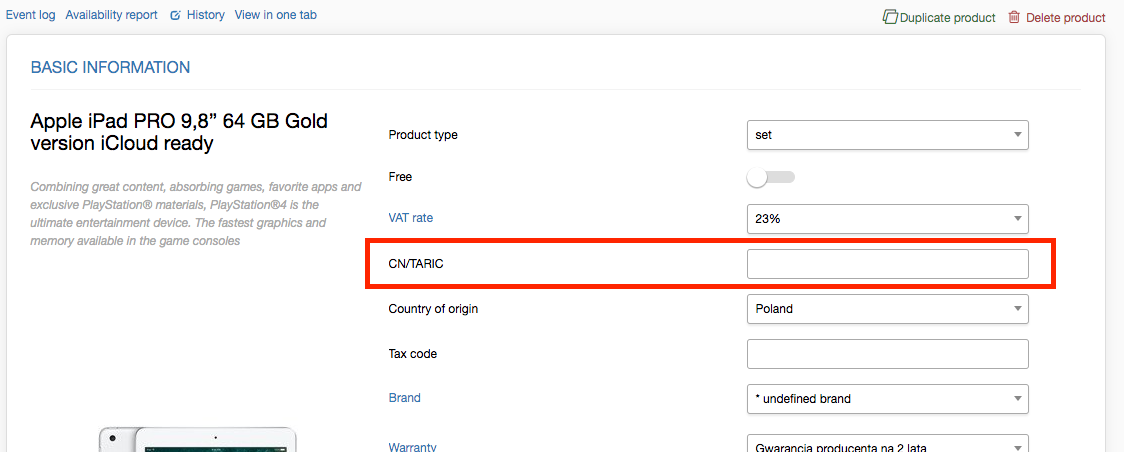

The set CN code is entered directly on the product card in the CN/TARIC field, through the Group Merchandise Edit (GET) or the API of the Administration Panel - using the Products/insert and Products/update methods.

After the CN codes are set, the mechanism shall, at each stage, determine the VAT rate for the EU country that has been entered as the destination country of the shipment

The calculated VAT rates shall always be verifiable on the commodity card irrespective of the mechanism activation status.

Adding custom exceptions for charging VAT rates for EU countries

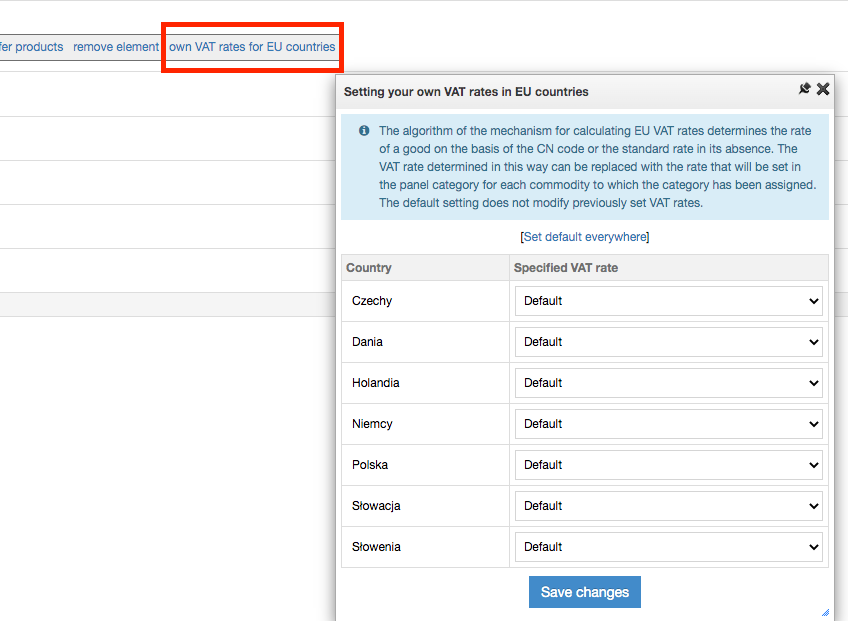

If you have not filled in the CN codes using the standard, basic VAT rates of the countries of supply, but you know that some of the products sold have their own reduced VAT rate - then you can change the rates set by the system by adding your own exceptions in the category of goods in

the administration panel GOODS / Categories of goods in the panel. The panel category can be further added to a particular commodity or a group of commodities. The exceptions thus added shall override any set VAT rate of the new mechanism.

Courier and its VAT rate

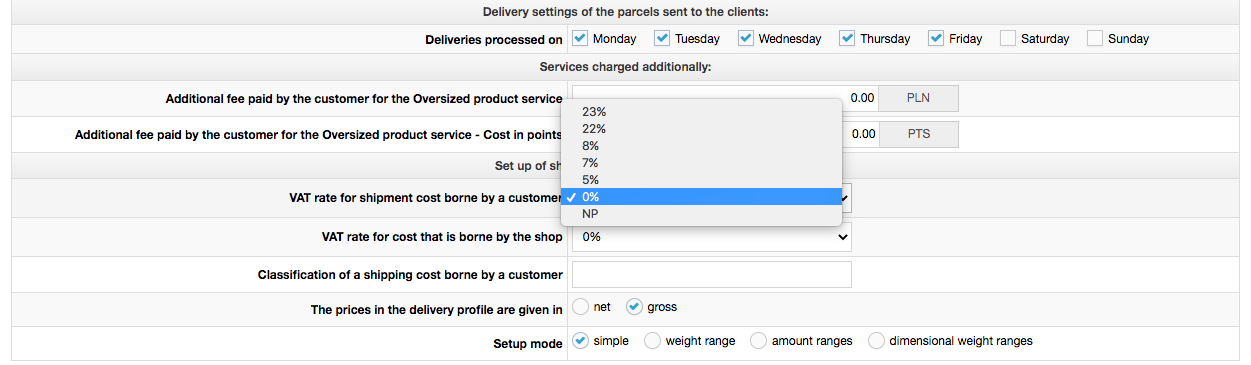

In order for the courier delivery to also use the correct VAT rate, you have to activate the EU VAT mechanism for courier VAT rates separately in section ADMINISTRATION / Configuration of tax settings.

This mechanism affects only the change of VAT rate, which will be visible in the order and transmitted to the sales document. It does not change the cost of delivery. Cost of delivery is taken from the assigned delivery profile.

Calculation of prices based on gross/net values

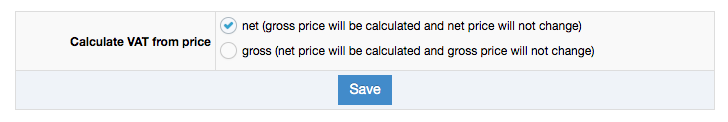

In the administration panel, the following two options are available for calculating the VAT value from the price:

- net (then the gross amount will be calculated based on the net amount given on the product card and the appropriate VAT rate)

- gross (then the gross amount will remain the same regardless of VAT rate)

Assuming that you set the gross option and you sell to customers from Poland and Germany, the system shall take into account the gross amount from the commodity card, e.g. 100 PLN, and this amount shall be payable both to the Polish and foreign customer (in PLN or after conversion depending on your settings in the currency configuration).

How the mechanism works with business-to-business (B2B) customers

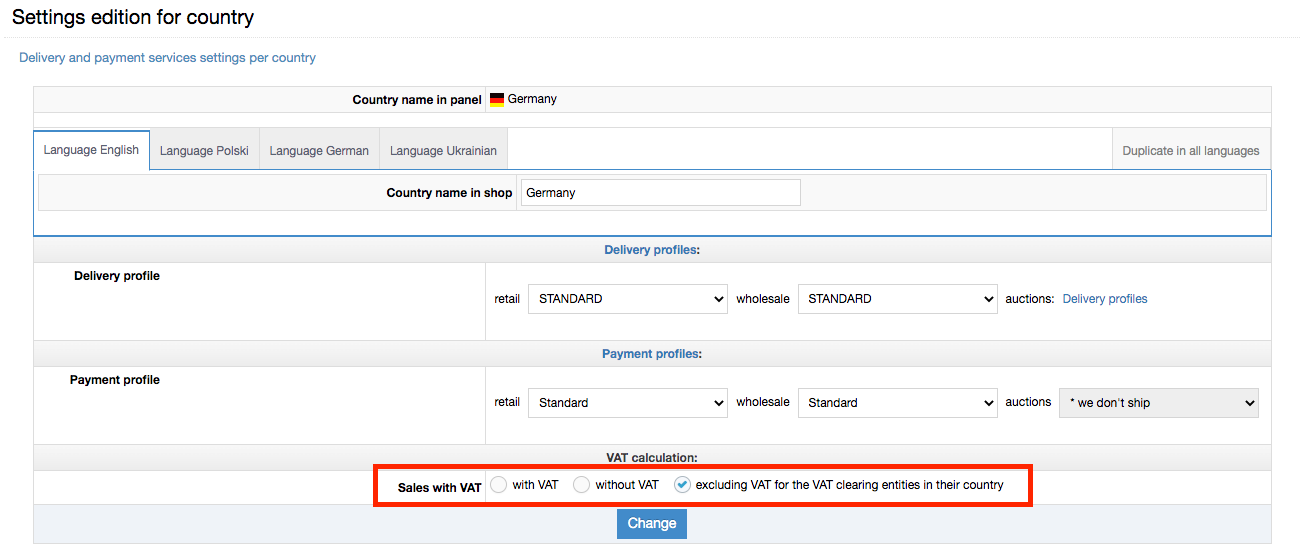

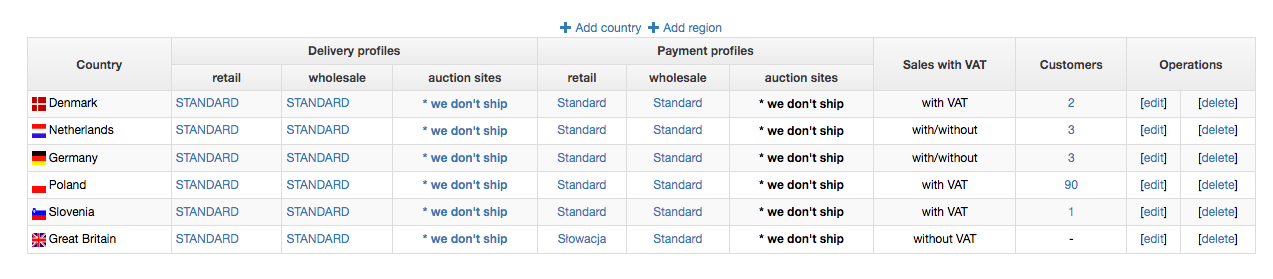

When the module is activated, VAT rates are assigned according to the option "I am a VAT EU payer. I order without VAT and I undertake to settle it in my country". In order for it to appear for the customer, you must select "Sale with VAT: without VAT for entities settling VAT in your country" in ADMINISTRATION / Settings of handling deliveries and payments for the country, in the edition of the selected EU country.

However, if the customer as a company does not select the above option, then the system treats such a customer as a consumer in B2C sales and according to the country of dispatch will calculate the local VAT rate.

Manual mapping of local VAT rates

We strongly recommend that you use the automatic mechanism to map VAT rates. However, you also have the option to use manual mapping of VAT rates.

To use this function, go to ADMINISTRATION / VAT rates. In the top right corner, there is the Settings link, which leads to a page allowing you to launch the manual mapping module.

After changing Allow setting other VAT rates for selected pages to YES, you can return to the previous page with the list of rates. A link Set other VAT rates for selected sites will appear in the top left bar. Then go to the appropriate page and adjust the VAT rates to your needs.

With the ability to map panel VAT rates not only at the store level, but also at the country level for shipping from your store, you will be able to sell to multiple countries with different VAT rates from one store.

To take advantage of this option, you must first define the countries to which the store will handle deliveries in the store panel in ADMINISTRATION / Settings of delivery and payment service for a country.

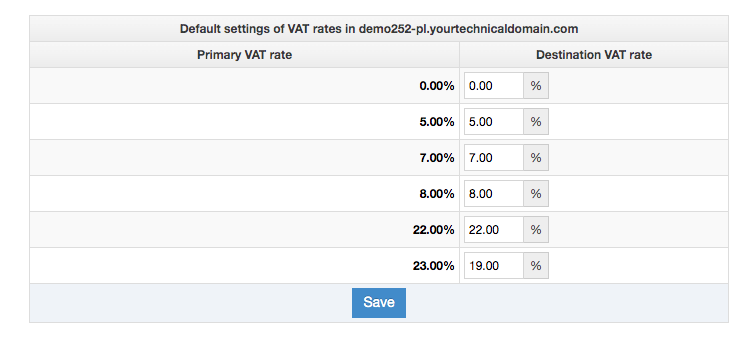

Next, in ADMINISTRATION / VAT rates / Setting other VAT rates for selected sites through the Add country link located above the list of VAT rates for the store, you shall go to the form for changing VAT rates for the selected country.

Then for the standard rate (indicated by default on the product card) you can specify the target VAT rate. Example: you specify that for customers from Germany the 23% VAT rate of the product, the system will change to 19% (as the target rate).

If you map VAT rates manually, it is not possible to add an individual rate for a given product. The mapping can be done only per store and per country.

Similar to the automatic mechanism for calculating EU VAT rates, there is an option to choose to calculate prices based on net or gross values.

Mapping of courier VAT rates

The above manual mapping of VAT rates does not affect courier services, i.e. the VAT rate of the delivery cost. You may indicate the VAT rate for a courier service for a given shipping country directly in the edition of the courier in section ADMINISTRATION / Configuration of deliveries / Delivery profiles / Profile edition, in the field "VAT rates of the customer cost".

If you have several shipping countries, you may create a separate delivery profile for each of them with an appropriate VAT rate. You can then assign the delivery profile for each country in section ADMINISTRATION / Settings of handling deliveries and payments for a country.

Operation of manual VAT rate mapping in B2B sales

This is done in the same way as the automatic mechanism for mapping VAT rates. When a customer placing an order for a company selects the option "I am a VAT EU payer. I order without VAT and I undertake to settle it in my country", the system will not charge VAT (order without VAT). Otherwise, the customer will be treated as a consumer and the system will set the VAT rate according to the set mapping.